Onboard with a hyper-accurate verification flow that's built for efficiency, with ID&V bank-grade KYC in under a minute. Due diligence to assess risk levels and avoid handling the proceeds of crime.

Verify wallet ownership and provide transparent on-chain proof of assets which aim to ensure that on-chain holdings of cryptocurrencies are sufficient to complete a specific transaction.

Achieve automated AML/CFT and sanctions compliance checks and obtain verifiable proof of funds certificate. Download or share POF certificate with receiver.

2-steps mechanism:

- Onboard with our passwordless authentication that enables a secure yet seamless customer experience. No need to create an account or to remember your password. Simply enter your email address, receive your one-time password (OTP) by email then confirm the code to log in.

- Proceed with Know Your Customer (KYC) verification with our dynamic solution. Verify your identity through Government-issued ID card, driving license or passport and face match. Verification as simple as taking a selfie.

- Anti Money Laundering (AML) compliance screening is performed in less than a second with AI-powered identity verification solution and by mapping in real-time against exhaustive AML watchlists databases to flag high-risk identities.

- Connect your cryptocurrency wallet to Amadeus secured web3 onboard application in one-click. Compatible Ethereum wallets include: Metamask, MEW, as well as hardware wallets Ledger and Trezor for enhanced security.

- Select token to certify and sign on-chain token ownership proof to validate wallet ownership and provide transparent on-chain proof of holding of assets. Currently supported on Amadeus Proof of Funds Certification dedicated tool: Ethereum blockchain main ERC-20 stablecoins.

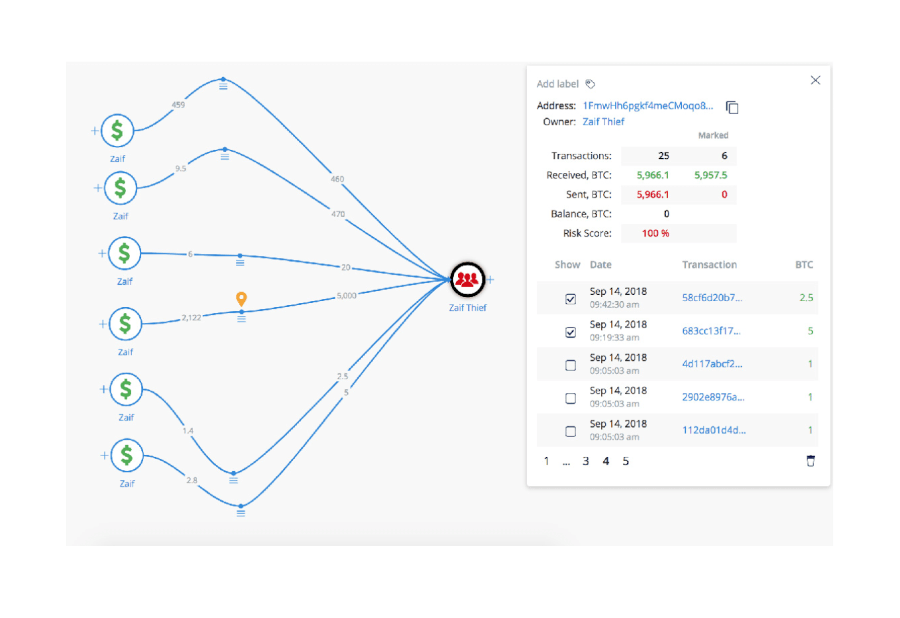

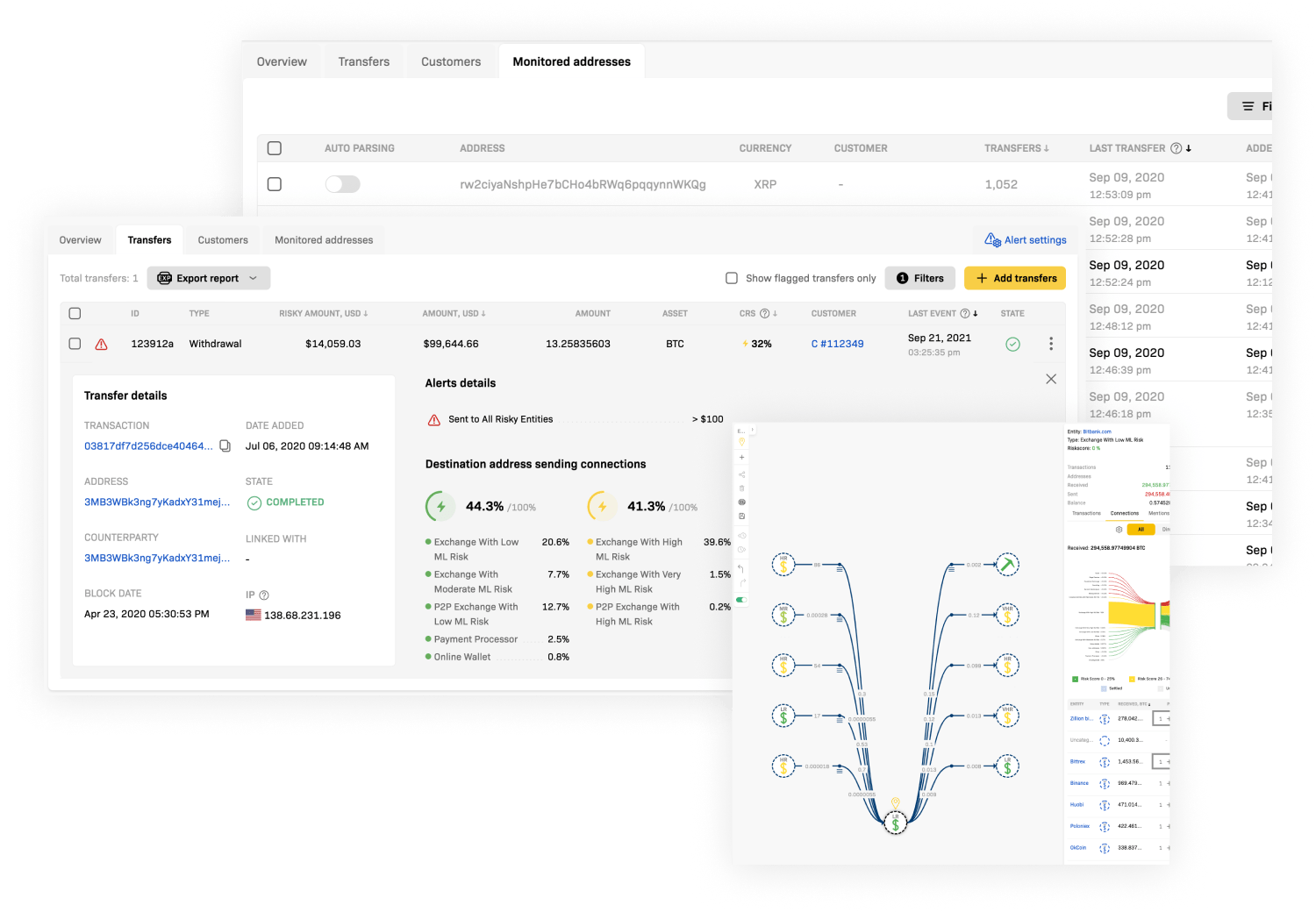

- Our solution analyzes and monitors blockchain transactions up to 100,000 hops in real-time to aid mitigating risk and assess accurate transaction risk level and origin of funds.

- Download your FREE Proof of Funds Certificate and share it with anyone to prove you are able to complete your cryptocurrency transaction with legitimate funds. As a receiver, verify document authenticity with QR-code.