Analytics Tools for Cryptocurrency Industries

Data Accuracy for Regulators:

Easy-to-use blockchain analysis tools provide Financial Intelligence Units (FIUs) and regulators with the ability to monitor and investigate suspicious cryptoasset activity.

Broad Transaction Coverage:

Ensures real-time information across all major blockchains and thousands of entities, currently attributing 90% of all active transactions.

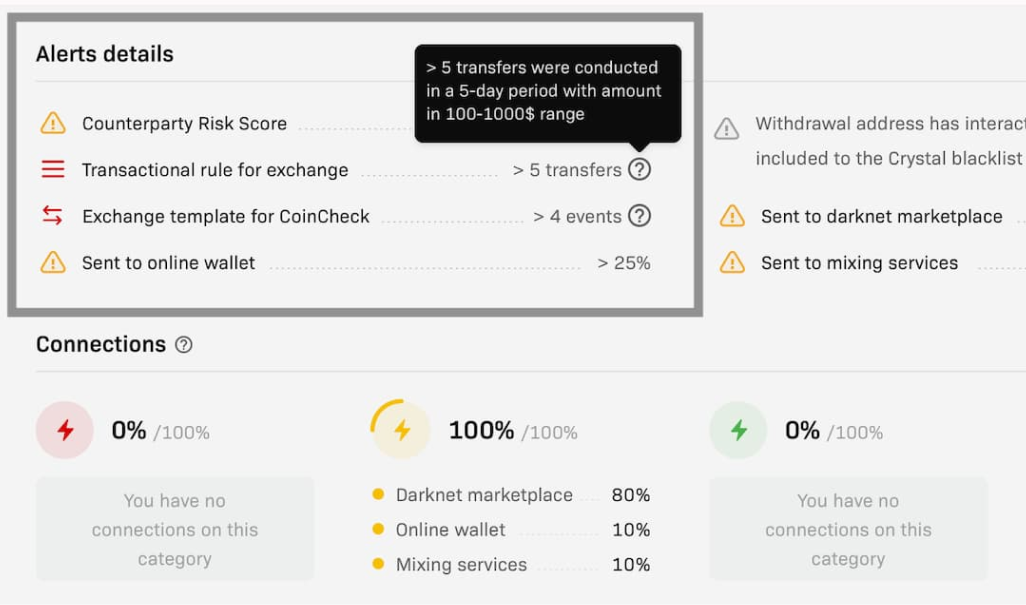

Identify High-Risk Customers:

Monitor your customers’ crypto activity across all of their crypto transactions. Detect suspicious activity early, using sophisticated analytics and risk indicators.

Automated & Evidence-based:

Provides immutable historical data logging with real-time updates and sophisticated risk-assessment. Available through API license.

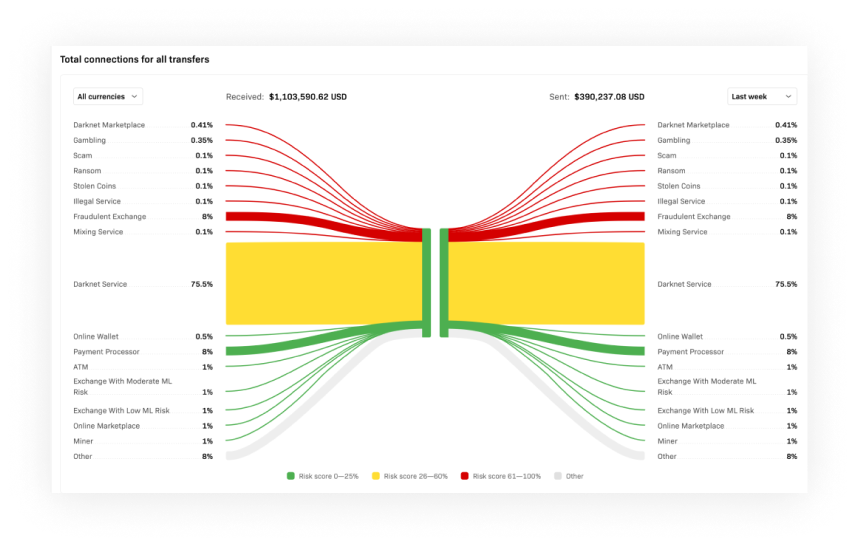

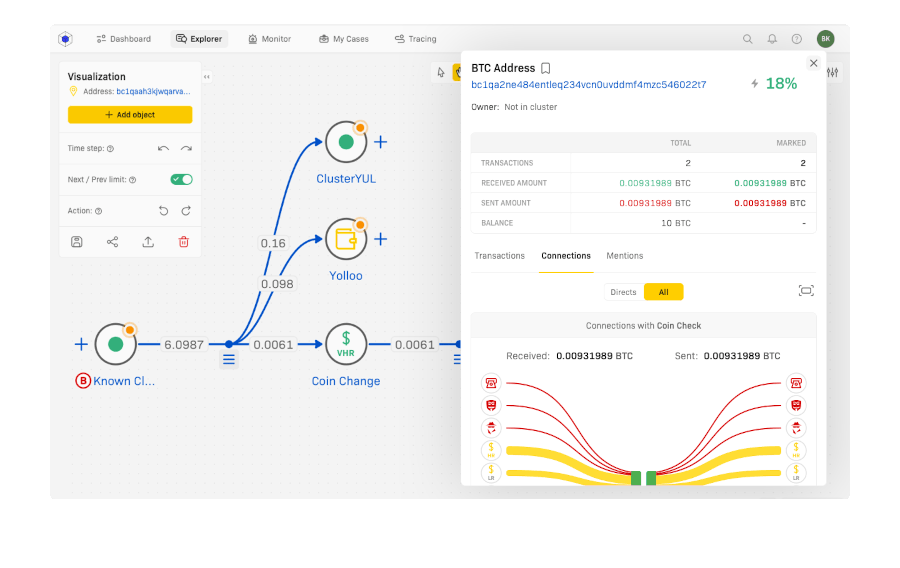

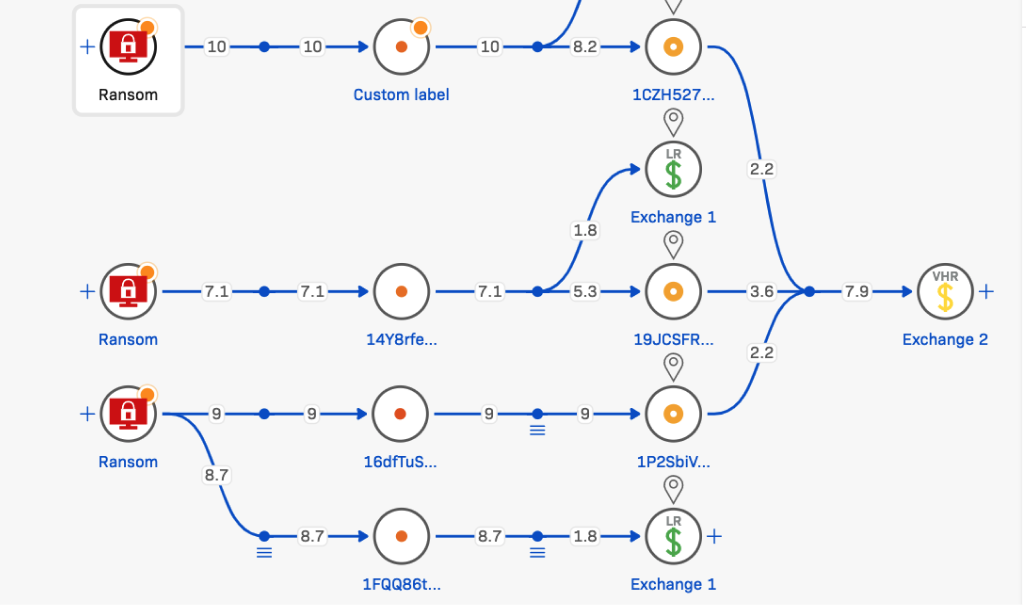

Trace Source and Destination of Funds:

Isolate where a transaction came from, or where it is being sent, by tracing through and across every major blockchain and asset concurrently to determine the ultimate source or destination of funds.

Visualization and Tracking Tools:

Case management solution maintains user-friendly case tracking that has been developed for secure, practical and collaborative use.

Detect High-Risk Crypto Transactions:

Speed up compliance checks, minimize manual intervention, and reduce costs with automated transaction risk scoring based on blockchain analytics.

Focus on Security:

Our license as an on-premise solution can be deployed in your IT infrastructure that keeps all sensitive data within the secure network perimeter.